Insights

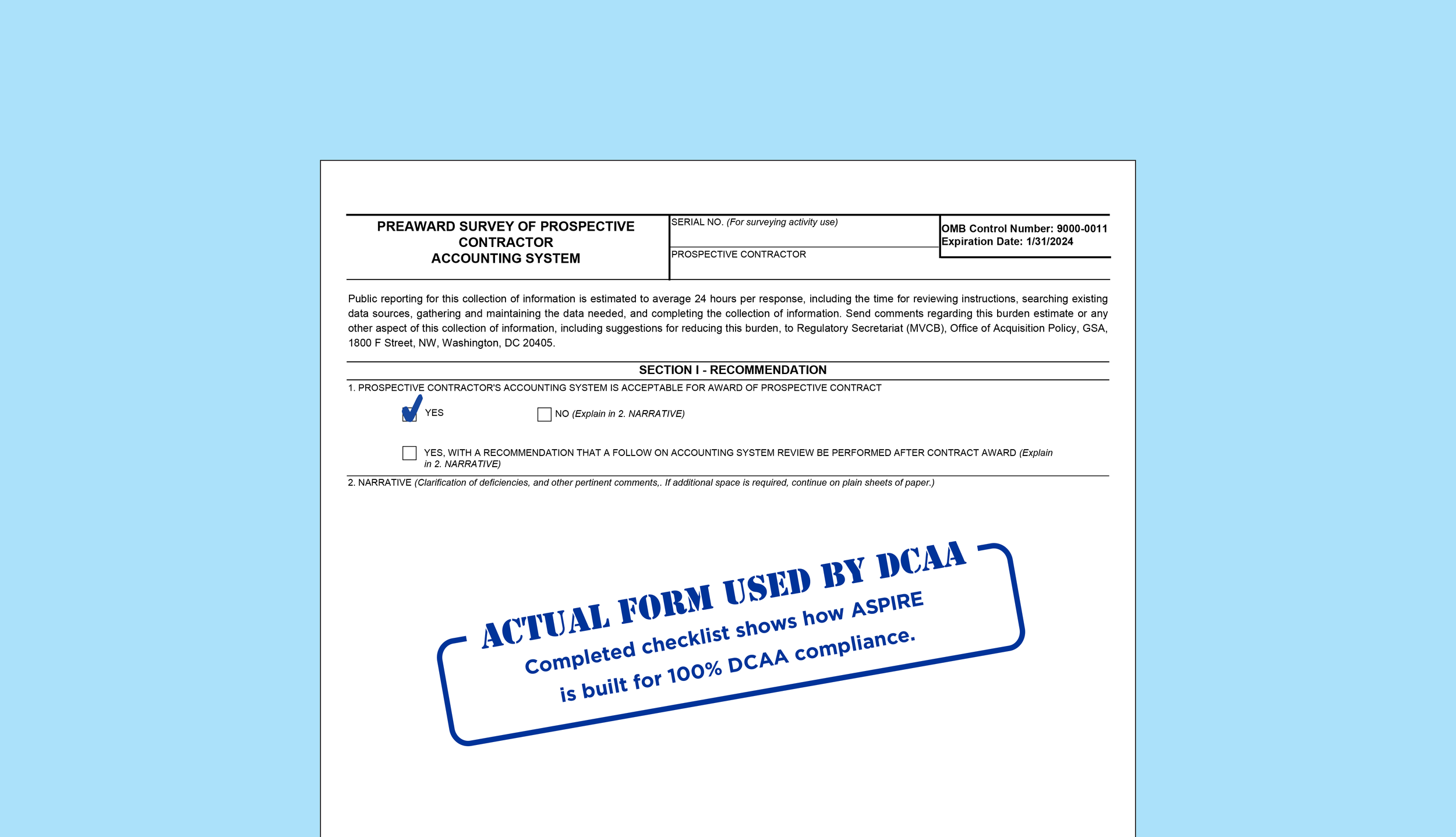

SF1408 Pre-Audit Award Basics

Compliance isn’t a certification you earn and then you’re done. Instead, DCAA compliance is an ongoing process. The most successful companies that pass DCAA audits every time without breaking a sweat are able to do so because they have business systems and resources in place to maintain and follow all government regulations and contract agreements.

Defense Contract Audit Agency: Incurred Cost Electronically Model

The ICE Model, which is the electronic version of the “Model Incurred Cost Proposal” provides contractors with a standard, user-friendly ICE submission package for preparing adequate incurred cost proposals in accordance with FAR 52.216-7, “Allowable Cost and Payment.” Contractors should ensure they use the most current version of the ICE model when preparing their incurred cost proposals.

Cost Accounting Standards (CAS): Office of Federal Procurement Policy

The purpose of this Cost Accounting Standard is to ensure that each contractor's practices used in estimating costs for a proposal are consistent with cost accounting practices used in accumulating and reporting costs. Consistency in the application of cost accounting practices is necessary to enhance the likelihood that comparable transactions are treated alike.

Federal Acquisition Regulation: Cost Principles Guide

The FAR (Federal Acquisition Regulation) provides essential guidelines for federal government contracting. Factors to consider when determining whether costs are allowable include: Reasonableness, Allocability, CAS Board Standards, Contract Terms, and newly published limitations, among others.

Defense Contract Audit Agency: Information for Contractors

The manual is designed to assist contractors in understanding applicable requirements and to help ease the contract audit process. It describes what contractors should expect when doing business with the U.S. Government and interacting with DCAA auditors.