Insights

“Deltek Stories.” The Mosaic Podcast

In this episode of The Mosaic Podcast, Brent Stinar engages with Delter founders, Ken deLaski and Eric Brown, in a rich discussion about the inception, growth, and impact of Deltek. They dive into the challenges and breakthroughs encountered while navigating the tech industry, offering insights into the entrepreneurial spirit that drove Deltek's success.

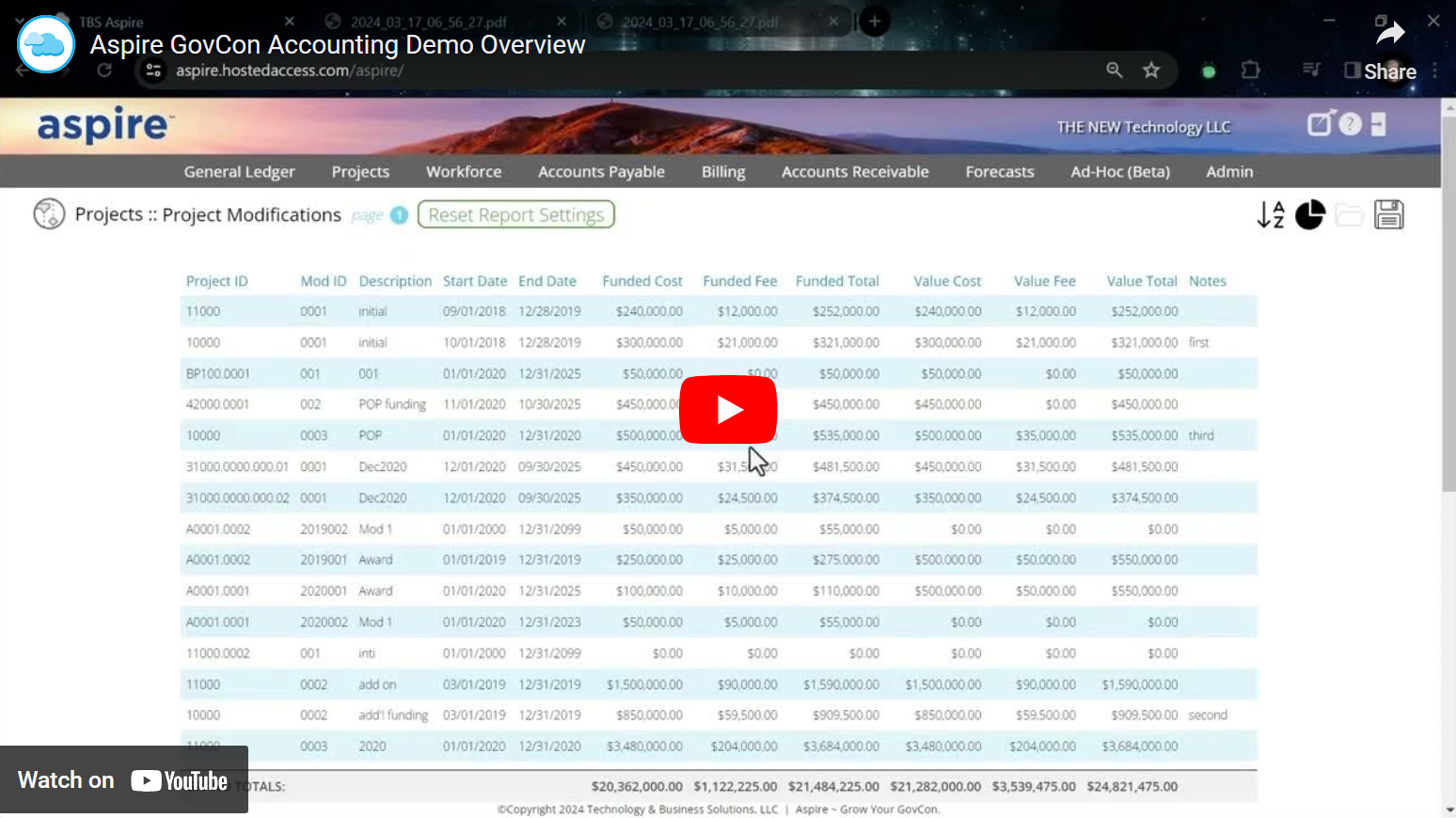

Aspire Demo Video (30-minute overview)

This high-level introductory demo for Aspire highlights all core functionality and modules — controls and GL basics, project views, workforce module, accounts payable, billing, accounts receivable, forecasting, report builder, timekeeping, and mobile timesheets.

“Let’s Solve for CMMC.” The Mosaic Podcast

February’s episode of The Mosaic Podcast from TBS dives into the complexities of compliance with insights from experts from the CMMC Consortium — Theo Pahigiannis, Jay Ethridge, Aaron Christmas, and Dr. Timothy Schilbach.

From Challenge to Opportunity: 8(a) and Black-Owned Government Contracting Strategies

People think the 8(a) small business program is a golden ticket. Learn to strategically use your 8(a) status for better business development.

Getting started with GovCon Timekeeping to support DCAA compliance.

The process of achieving DCAA compliance is a bit of a misnomer, as the DCAA does not actually certify contractors as compliant. Instead, compliance means establishing and maintaining accounting practices that meet the DCAA's requirements for accuracy, reliability, and integrity, so that your firm is prepared for an audit. Timekeeping is a significant component of preparedness.

Feature Focus :: Multi-level Account and Project Support ~ update

COMING SOON: The best part about Aspire’s flexible support for both multi-level projects and accounts is that one size does not need to fit all. With Aspire, you’re free to mix and match the depth of project and account structures contract by contract. This helps with planning your best performance models too.

DCAA Audits and Compliance Checklists: Focus First on Timekeeping.

The Defense Contract Audit Agency (DCAA) conducts several types of audits to evaluate various aspects of a contractor’s financial and operational compliance with federal regulations. Each type of audit focuses on specific areas of concern, ensuring that contractors adhere to the principles of accountability and efficiency in their dealings with the government.

Fundamentals of Compliant Timekeeping: DCAA Challenges and Business Benefits.

Timekeeping is a major focus of Defense Contract Audit Agency (DCAA) compliance, the standards used to ensure that all contracts comply with government standards and protect taxpayer dollars by detecting fraudulent billing. There are many reasons why a business interested in contracting with the government should take DCAA compliance seriously.

How to Find Federal Agencies Who Love 8(a) Government Contractors?

Take a deep dive into the government contracting award data for the SBA 8(a) Business Development program.

Feature Focus :: Game-changing AP automation

COMING SOON: Aspire’s unique Accounts Payable features include built-in optical character recognition, machine learning, and workflows. In practice, this means that Aspire handles voucher entry, coding, and assignments for you as soon as A/P invoices and documents hit the system, saving you tons of time and dramatically reducing errors.

Feature Focus :: Daily Job Costs with Fully Burdened Labor

COMING SOON: On a daily basis, all Aspire project reports sync the latest direct expenses and timesheet entries as they’re entered into the system. Daily labor details are fully burdened with all applicable rates for real-time performance visibility.

Feature Focus :: GovCon, Commercial, Regional Business Units

COMING SOON: Even as their government contracting divisions begin to take flight and scale, many growing businesses still rely heavily on commercial contracts and other ventures. Aspire easily accommodates all scenarios with support for multiple business units.

CMMC: First focus on starting. (Then worry about finishing.)

If you’re not yet prepared for your CMMC assessment – or you’re still not sure where to begin – our Altus compliance team breaks it all down and gives you a consolidated and cost-effective launch point for CMMC success. Our model focuses not on your destination, but on how to successfully jump-start your journey.

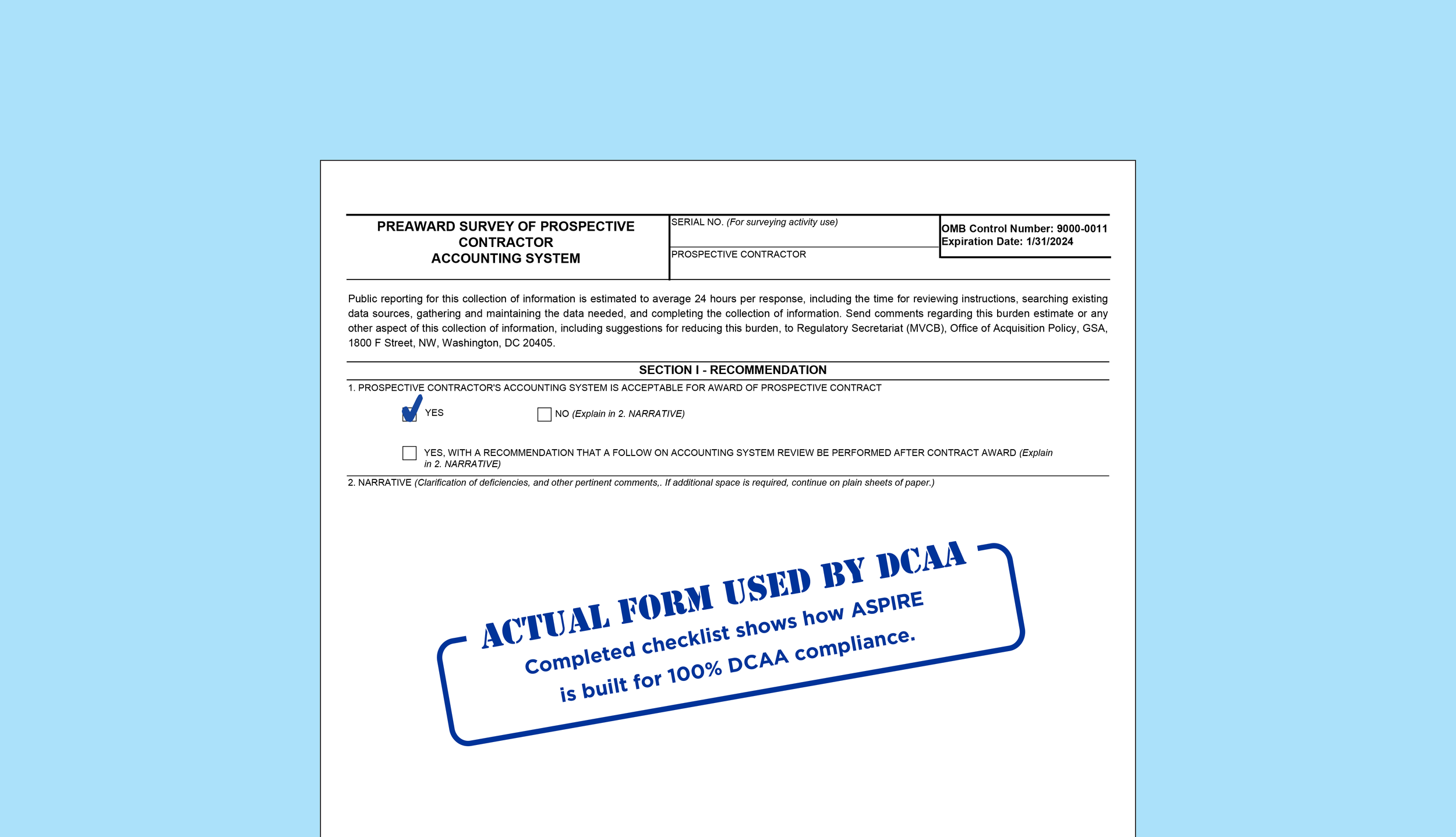

SF1408 Pre-Audit Award Basics

Compliance isn’t a certification you earn and then you’re done. Instead, DCAA compliance is an ongoing process. The most successful companies that pass DCAA audits every time without breaking a sweat are able to do so because they have business systems and resources in place to maintain and follow all government regulations and contract agreements.

Feature Focus :: Cost Pools and Your Indirect Rates

COMING SOON: As Aspire supports unlimited cost pools for Fringe, Overhead, G&A and other rates, growing businesses may easily match their new current business operations and landscape with their new accounting platform. The results are impressive.

ECM Spotlight

COMING MAY: An interview with TBS Director of ECM Systems, Arpit Jain.

3 Paths to Federal Revenue: How to Win Federal Government Contracts and Subcontracts

✅ Here are two huge mistakes frequently made by small business federal contractors.

➡️ Mistake #1 – You rush to bid on prime contracts with federal agencies before you are ready

➡️ Mistake #2 – You don't establish a strategy to subcontract with small businesses

In this training video, Neil McDonnell walks through the process.

👉 What are the three paths to earning revenue in the federal market

👉 When to pursue each revenue path

👉 How to evaluate your pipeline against the 3 revenue paths

Defense Contract Audit Agency: Incurred Cost Electronically Model

The ICE Model, which is the electronic version of the “Model Incurred Cost Proposal” provides contractors with a standard, user-friendly ICE submission package for preparing adequate incurred cost proposals in accordance with FAR 52.216-7, “Allowable Cost and Payment.” Contractors should ensure they use the most current version of the ICE model when preparing their incurred cost proposals.

Step-By-Step Guide for 8(a) Success | Government Contracting

The 8(a) certification is a 'Golden Ticket' — but only if you show up and redeem that ticket. More than half of 8(a) firms either don't win a contract at all, or crash and burn after their 9th year.

Cost Accounting Standards (CAS): Office of Federal Procurement Policy

The purpose of this Cost Accounting Standard is to ensure that each contractor's practices used in estimating costs for a proposal are consistent with cost accounting practices used in accumulating and reporting costs. Consistency in the application of cost accounting practices is necessary to enhance the likelihood that comparable transactions are treated alike.