Insights

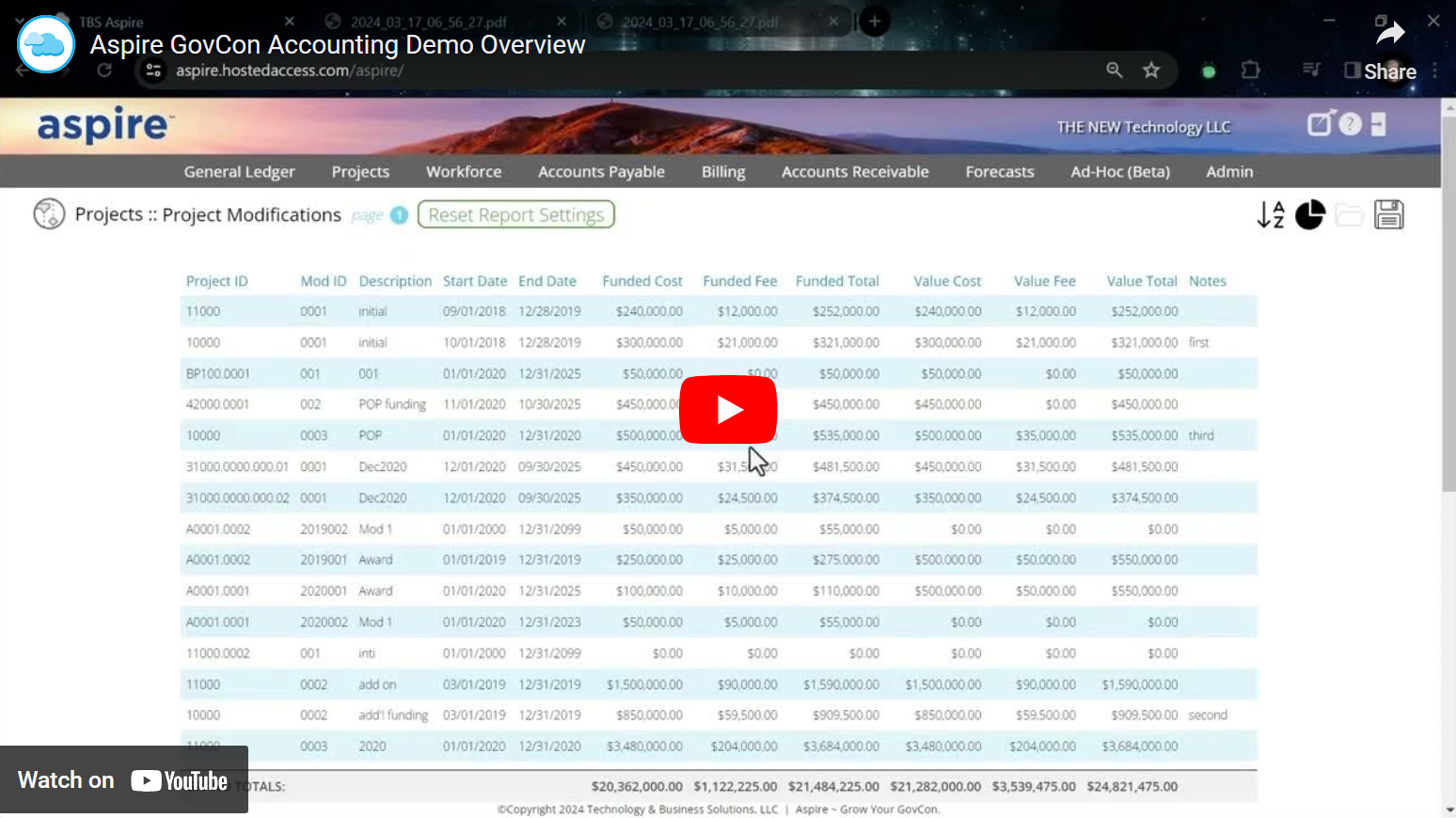

Aspire Demo Video (30-minute overview)

This high-level introductory demo for Aspire highlights all core functionality and modules — controls and GL basics, project views, workforce module, accounts payable, billing, accounts receivable, forecasting, report builder, timekeeping, and mobile timesheets.

DCAA Audits and Compliance Checklists: Focus First on Timekeeping.

The Defense Contract Audit Agency (DCAA) conducts several types of audits to evaluate various aspects of a contractor’s financial and operational compliance with federal regulations. Each type of audit focuses on specific areas of concern, ensuring that contractors adhere to the principles of accountability and efficiency in their dealings with the government.

Fundamentals of Compliant Timekeeping: DCAA Challenges and Business Benefits.

Timekeeping is a major focus of Defense Contract Audit Agency (DCAA) compliance, the standards used to ensure that all contracts comply with government standards and protect taxpayer dollars by detecting fraudulent billing. There are many reasons why a business interested in contracting with the government should take DCAA compliance seriously.

CMMC: First focus on starting. (Then worry about finishing.)

If you’re not yet prepared for your CMMC assessment – or you’re still not sure where to begin – our Altus compliance team breaks it all down and gives you a consolidated and cost-effective launch point for CMMC success. Our model focuses not on your destination, but on how to successfully jump-start your journey.

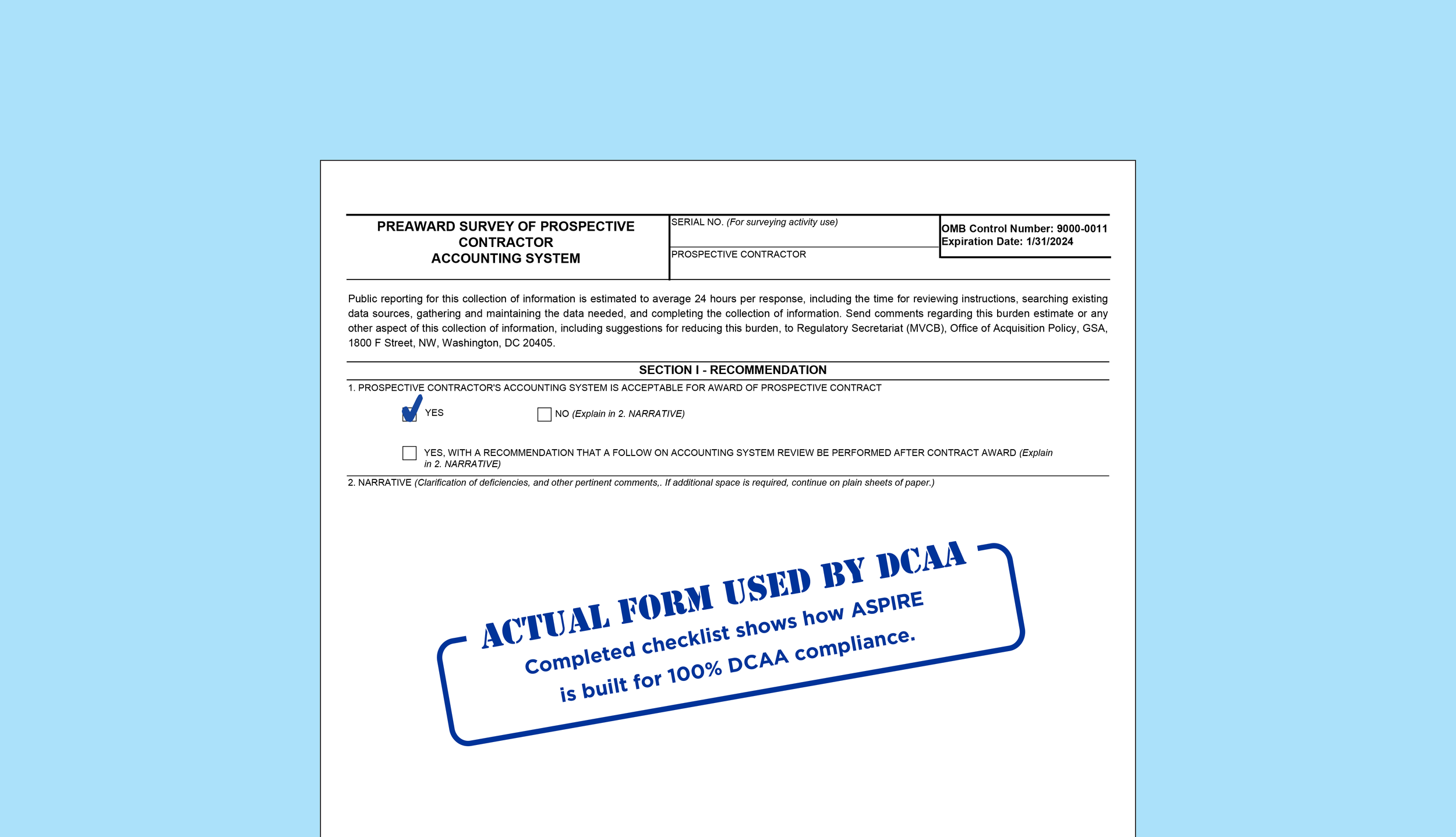

SF1408 Pre-Audit Award Basics

Compliance isn’t a certification you earn and then you’re done. Instead, DCAA compliance is an ongoing process. The most successful companies that pass DCAA audits every time without breaking a sweat are able to do so because they have business systems and resources in place to maintain and follow all government regulations and contract agreements.

Cost Accounting Standards (CAS): Office of Federal Procurement Policy

The purpose of this Cost Accounting Standard is to ensure that each contractor's practices used in estimating costs for a proposal are consistent with cost accounting practices used in accumulating and reporting costs. Consistency in the application of cost accounting practices is necessary to enhance the likelihood that comparable transactions are treated alike.

Defense Contract Audit Agency: Information for Contractors

The manual is designed to assist contractors in understanding applicable requirements and to help ease the contract audit process. It describes what contractors should expect when doing business with the U.S. Government and interacting with DCAA auditors.

DCAA-Compliant Timekeeping: Labor and Payroll Audit Trails

In addition to making sure that your contract labor is accounted for accurately and in accordance with DCAA standards, there are several key compliance and documentation steps to follow when utilizing captured labor hours for compensating employees and applicable subcontractors.